Women Entrepreneur- Hermagic

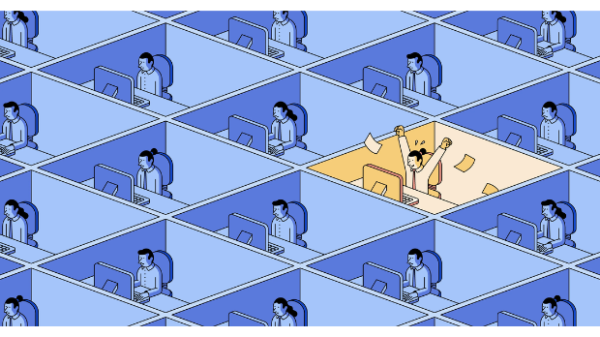

In the United States, a record-breaking 5,4 million individuals filed paperwork to establish new companies last year. Last month’s LA conference brought together innovators, CEOs, and enter-precurious people from all walks of life, proving that the entrepreneurial spirit is alive and well.

During a conversation titled “So You Want to Start a Business,” four successful female entrepreneurs shared their insights on the subject of launching and building a company. In other words, the panellists were prepared. Raise your hands if you agree or disagree:

Our host, Mastercard’s North American Small Business Lead Ginger Seigel, will also be joining us.

The four of them had, as you might expect, a lot of advice to provide to people who are in the “Should I?” phase of starting a business. Here, we’ve compiled all that information into a checklist to assist you determine if your concept is ready for launch.

1. Is What I’m Planning To Do a Good (and potentially profitable) Company Idea?

Women Entrepreneur- Hermagic

As soon as the “OMG, I got an idea!” rush wears off, you’ll need to start thinking about whether or not your company plan has any chance of succeeding. Gonzalez has done her fair share of mentoring founders at Bank of America, and you can tell that it brings her great joy.

“Small enterprises are so wonderful!” she exclaimed from the podium. There’s a lot of heart in the people who run their own businesses. It’s always thrilling whenever I have the chance to visit a local establishment in their own setting. There’s nothing to more satisfying than seeing the smiles on the faces of hardworking entrepreneurs.

According to Gonzalez, your level of ambition is the single most crucial factor before you ever begin. Many of our business owners found the recent outbreak of COVID-19 to be very trying, she says. No matter how things may be going in your life, you must always have ambition and enthusiasm for your work.

What’s the other main component? A plan! Gonzalez outlines why you should investigate your company thoroughly: Who are the people you’re up against? In what ways can this company expand? In what setting will you have the most success? What exactly do you intend to do to achieve your goals? There are a lot of moving parts in a successful venture, but you’ll be well on your way if you can focus your goal and learn your industry inside and out.

2. Do I Accept Responsibility For, And Develop a Healthier Perspective On, My Relationship With Money?

Women Entrepreneur- Hermagic

Although Sokunbi is the owner of a company that helps people achieve financial independence, she has made her share of financial blunders in the past. In spite of her openness about her own background, she does point out a typical financial mistake that many new business owners make.

To paraphrase what she says, “we let our mistakes force us into a corner where we start to feel humiliated or dissatisfied, but we want to own those mistakes because these failures are opportunities for us to examine what went wrong, what we didn’t like, and how to position ourselves next time.” Then you can put the error in the bin while holding on to the lessons it taught you.

3. To What Extent Does My Company’s Story Stand Out?

Women Entrepreneur- Hermagic

You’ll be doing a lot of self-promotion as a business owner. Think about how often the story of how Steve Jobs got his start in his parent’s garage has been told. Gonzalez reveals his trade secrets for crafting a compelling story for yourself and your company.

She advises, “Let your enthusiasm shine through so people can feel it.” It’s not what you’re doing that matters; it’s how you’re doing it that matters even more. People around you may be thinking the same thing, but it’s up to you to choose whether or not that concept will succeed. If you’re looking for a formula, all you need is some personal enthusiasm and a great business idea.

4. When It comes to Finances, Am I In Good Shape?

Women Entrepreneur- Hermagic

In order to feel assured and in charge as you see your vision come to existence, it is crucial to arrange your financial resources. That’s why it’s crucial to organise your organization’s financials, and the Bank of America platform for small businesses may assist you in doing just that, with services like business checking and charge cards. Make an appointment with a banker to talk about your specific situation; a dedicated expert there will help you formulate a strategy.

As your business idea germinates, Sokunbi suggests perusing the Small Business Administration‘s (SBA) website for information on funding, licences, and education. Keep in mind that the crew over at Create & Cultivate is always willing to lend a hand.

Conclusion

Hermagic is the UK’s most popular young women’s media brand, and our editors work hard to offer you fresh, funny, and necessary content. It help us to provide information about fashion, beauty, lifestyle, career, relationship and so on.

Read more about hermagic